Car insurance is more than just a legal requirement—it’s your financial safety net on the road. Whether you’re a daily commuter, a weekend road-tripper, or someone who barely drives, having the right car insurance policy can save you from unexpected expenses in case of an accident, theft, or damage.

At its core, vehicle insurance is designed to protect you from financial losses related to your car. Without proper coverage, even a minor fender bender could leave you facing hefty repair bills. Worse, if you’re found liable in an accident, the costs can skyrocket. That’s where auto insurance comes in, ensuring that you, your passengers, and others on the road are protected.

But not all policies are the same. From comprehensive car insurance to liability-only coverage, choosing the right plan depends on your driving habits, budget, and legal requirements. In this guide, we’ll break down the essentials to help you make informed decisions.

Understanding Different Types of Car Insurance Coverage

Choosing the right car insurance coverage is crucial to protecting yourself, your vehicle, and others on the road. Insurance policies vary in scope, cost, and level of protection, so understanding your options will help you make an informed decision. Below are the main types of auto insurance coverage and what they include.

1. Liability Insurance

Liability insurance is the most basic and legally required coverage in most states. It consists of two parts:

- Bodily Injury Liability (BIL) – Covers medical expenses, lost wages, and legal costs for the other party if you’re at fault in an accident.

- Property Damage Liability (PDL) – Pays for repairs to another person’s vehicle or property, such as a fence or building, if you cause an accident.

While cheap car insurance often includes minimum liability coverage, it may not be enough to fully cover damages in a serious accident.

2. Collision Coverage

Collision insurance helps pay for repairs to your car if it’s damaged in an accident, regardless of who is at fault. This includes:

- Collisions with other vehicles

- Hitting an object (like a tree, pole, or guardrail)

- Single-car accidents (e.g., rolling over)

If you have a loan or lease, lenders typically require collision coverage as part of a full coverage car insurance plan.

3. Comprehensive Coverage

Comprehensive insurance covers non-collision-related damages, such as:

- Theft

- Vandalism

- Natural disasters (floods, hurricanes, earthquakes)

- Fire

- Animal-related damage (e.g., hitting a deer)

Since this coverage protects against unforeseen events, it is a valuable addition to a best car insurance policy.

4. Uninsured/Underinsured Motorist Coverage

Despite legal requirements, many drivers still operate vehicles without auto insurance. If you’re in an accident with an uninsured or underinsured driver, this coverage helps pay for:

- Medical expenses

- Vehicle repairs

- Lost wages if you’re unable to work

This type of policy ensures you’re not left covering costs due to someone else’s lack of car insurance coverage.

5. Personal Injury Protection (PIP) & Medical Payments (MedPay)

Medical expenses can add up quickly after an accident. PIP and MedPay help cover:

- Hospital bills and rehabilitation costs

- Lost wages if you’re unable to work

- Funeral expenses (if necessary)

PIP is required in some states and provides broader coverage than MedPay, often including essential services like childcare if you’re injured.

Choosing the Right Coverage for Your Needs

Selecting the right car insurance policy depends on your budget, driving habits, and personal risk tolerance. A combination of liability, collision, and comprehensive car insurance often provides the best protection. If you’re unsure, it’s always wise to compare car insurance quotes and consult with a provider to find the most suitable coverage.

Factors Influencing Car Insurance Premiums

Car insurance rates aren’t random—they’re based on a variety of factors that help insurance companies assess risk. Understanding what influences your car insurance premiums can help you make informed decisions and even lower your costs. Here are the key factors that affect how much you pay for auto insurance.

1. Driving Record

Your driving history is one of the biggest factors in determining your car insurance rates. Insurance companies look at:

- Traffic violations – Speeding tickets, reckless driving, and DUIs can increase premiums significantly.

- Accidents – At-fault accidents make you a higher risk, leading to higher auto insurance costs.

- Claims history – Frequent claims, even for minor incidents, can raise your rates over time.

A clean driving record often qualifies you for insurance discounts and lower premiums.

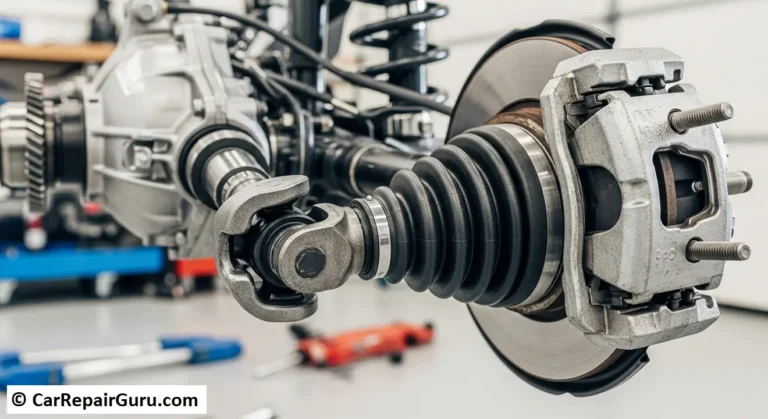

2. Vehicle Type

The make, model, and year of your car play a major role in your insurance premiums. Insurers consider:

- Repair and replacement costs – Luxury cars and sports cars cost more to insure due to expensive repairs.

- Safety features – Vehicles with advanced safety technology may qualify for car insurance discounts.

- Theft risk – Some car models are more likely to be stolen, leading to higher comprehensive car insurance rates.

If you’re shopping for a new car, consider checking car insurance quotes for different models before making a decision.

3. Location

Where you live impacts your car insurance coverage costs due to:

- Crime rates – High-theft areas lead to higher comprehensive coverage premiums.

- Traffic congestion – More accidents in urban areas mean higher liability insurance costs.

- State laws – Minimum auto insurance requirements vary by state, affecting rates.

Living in a low-crime, rural area typically results in lower vehicle insurance costs.

4. Credit Score

Many insurers use credit scores to determine premiums. A higher credit score often means:

- Lower perceived risk

- Access to better insurance rates

- Potential discounts on full coverage car insurance

Maintaining a good credit score can help you secure affordable car insurance.

5. Annual Mileage

How much you drive annually also affects your insurance premiums. Insurance providers assume that:

- More miles on the road = higher accident risk

- Low-mileage drivers qualify for discounted auto insurance

If you drive less than the average person, consider usage-based insurance programs that adjust your rates based on actual mileage.

By understanding these factors, you can take steps to lower your car insurance costs while ensuring you have the right level of auto insurance coverage.

Tips to Secure the Best Car Insurance Rates

Finding the right car insurance policy at an affordable price requires more than just choosing the first option available. Insurance companies use different pricing models, meaning rates can vary widely. Here are some effective strategies to help you get the best car insurance rates without sacrificing essential coverage.

1. Shop Around and Compare Quotes

Not all car insurance companies offer the same rates, even for identical coverage. Comparing multiple car insurance quotes allows you to:

- Identify the most affordable car insurance providers.

- See which companies offer the best discounted auto insurance rates.

- Avoid overpaying for coverage you don’t need.

Use online comparison tools or contact different auto insurance companies directly to get quotes and find the best deal.

2. Bundle Policies for More Savings

Many insurers offer discounts when you bundle multiple policies, such as:

- Auto and home insurance

- Auto and renters insurance

- Multi-car insurance (if you insure more than one vehicle under the same provider)

Bundling can lower your insurance premiums and simplify policy management with a single provider.

3. Maintain a Clean Driving Record

Your driving record has a major impact on car insurance rates. To keep your premiums low:

- Follow traffic laws – Avoid speeding tickets, reckless driving, and DUIs.

- Drive defensively – Reduce the risk of at-fault accidents.

- Take a defensive driving course – Some insurers offer insurance discounts for completing these courses.

A clean driving record makes you eligible for cheap car insurance and special safe driver discounts.

4. Consider Usage-Based or Pay-Per-Mile Insurance

If you’re a low-mileage driver, switching to a usage-based insurance (UBI) or pay-per-mile insurance program can lower costs. These programs track driving behavior and mileage using a mobile app or a plug-in device, rewarding safe and infrequent drivers with lower auto insurance rates.

5. Ask About Discounts

Insurance providers offer various discounts that can significantly reduce car insurance costs. Ask your insurer about:

- Good driver discounts – For accident-free driving records.

- Good student discounts – For young drivers with high grades.

- Vehicle safety discounts – For cars with anti-theft devices, airbags, and advanced safety features.

- Loyalty discounts – For staying with the same insurer for multiple years.

- Military or senior discounts – Special pricing for eligible groups.

Always inquire about available insurance discounts to maximize your savings.

6. Adjust Your Deductibles to Lower Premiums

Your deductible is the amount you pay out of pocket before your insurance kicks in. Adjusting it can impact your car insurance premiums:

- Higher deductible = lower monthly premiums (but more out-of-pocket costs in case of a claim).

- Lower deductible = higher monthly premiums (but less financial strain when filing a claim).

If you have an emergency fund to cover unexpected repairs, opting for a higher deductible can help you get cheaper car insurance.

Final Thoughts

Finding affordable car insurance requires smart decision-making and a proactive approach. By comparing rates, maintaining a clean record, taking advantage of discounts, and choosing the right auto insurance coverage, you can secure the best protection at the lowest possible cost.

Steps to Purchase Car Insurance

Buying car insurance may seem overwhelming, but following a structured approach makes the process straightforward. Here’s a step-by-step guide to help you secure the best auto insurance policy for your needs.

1. Gather Necessary Information

Before requesting car insurance quotes, you’ll need to provide insurers with key details, including:

- Personal information – Name, address, date of birth, and driver’s license number.

- Vehicle details – Make, model, year, VIN (Vehicle Identification Number), and mileage.

- Driving history – Past accidents, claims, and traffic violations.

- Current insurance details (if applicable) – Information about your existing auto insurance coverage.

Having these documents ready speeds up the process and ensures accurate quotes.

2. Assess Your Coverage Needs

Understanding what level of car insurance coverage you need is crucial. Consider the following:

- State minimum requirements – Ensure compliance with local laws.

- Vehicle value – Older cars may not need comprehensive car insurance or collision coverage.

- Personal finances – Higher coverage limits can prevent financial strain in case of an accident.

- Driving habits – Frequent drivers may benefit from additional protections like uninsured motorist coverage.

Choosing the right auto insurance policy ensures you get the best balance between affordability and protection.

3. Obtain and Compare Quotes

Request quotes from multiple car insurance companies to find the best rates. When comparing offers, consider:

- Premium costs – Monthly or annual payments.

- Coverage details – What’s included in each policy.

- Deductibles – Higher deductibles lower premiums but increase out-of-pocket costs.

- Discounts – Ask about car insurance discounts for safe driving, bundling, or other qualifications.

Using online tools or working with an independent agent can simplify the comparison process.

4. Finalize and Purchase the Policy

Once you’ve selected the best car insurance policy, follow these final steps:

- Review the policy – Ensure all terms, coverages, and exclusions match your needs.

- Confirm payment details – Choose between monthly, semi-annual, or annual payment options.

- Obtain proof of insurance – This is required for vehicle registration and driving legally.

By following these steps, you can confidently purchase car insurance coverage that fits your budget and provides the protection you need.

Common Mistakes to Avoid When Buying Car Insurance

Purchasing car insurance is a crucial financial decision, but many drivers make costly mistakes that leave them underinsured or overpaying for coverage. Here are the most common pitfalls to avoid when selecting an auto insurance policy.

1. Choosing Insufficient Coverage

Opting for the cheapest car insurance policy may seem like a smart way to save money, but it can leave you vulnerable. Risks of minimal coverage include:

- High out-of-pocket expenses – If you’re in an accident, basic liability insurance won’t cover your own vehicle repairs.

- Inadequate medical coverage – Without personal injury protection (PIP) or MedPay, you may struggle with medical bills.

- Limited protection against uninsured drivers – Uninsured/underinsured motorist coverage is essential if the other driver lacks proper insurance.

Choosing comprehensive car insurance or full coverage auto insurance can provide the financial security you need.

2. Overlooking Policy Exclusions

Many policyholders assume that auto insurance coverage protects against all possible incidents, but exclusions often apply. Common policy exclusions include:

- Wear and tear – Insurance won’t cover regular maintenance or mechanical breakdowns.

- Personal belongings – Items stolen from your car may not be covered under car insurance but could be under renters or homeowners insurance.

- Commercial use – Using your personal vehicle for business purposes without proper coverage can result in denied claims.

Reading the fine print and asking your insurer about specific insurance exclusions ensures you understand your policy’s limitations.

3. Not Reviewing Your Policy Annually

Many drivers purchase auto insurance and forget about it, missing out on potential savings or necessary updates. Regular policy evaluations help you:

- Adjust coverage as needed – Your insurance needs change over time, especially if you buy a new car or move to a different location.

- Take advantage of discounts – New car insurance discounts may be available based on safe driving, bundling, or life changes.

- Ensure competitive pricing – Shopping around for car insurance quotes yearly can help you secure better rates.

By avoiding these common mistakes, you can ensure that your car insurance policy provides the right level of protection while keeping costs manageable.

Conclusion

Selecting the right car insurance policy is essential for protecting yourself financially and ensuring peace of mind on the road. By understanding the different types of car insurance coverage, comparing multiple car insurance quotes, and avoiding common mistakes, you can secure a policy that offers the best balance between cost and protection.

Remember to assess your coverage needs carefully, take advantage of available car insurance discounts, and review your policy annually to ensure it still meets your requirements. Whether you’re a new driver or looking to switch providers, making informed decisions about auto insurance can save you money while keeping you fully protected.

By following the steps outlined in this guide, you can confidently navigate the car insurance process and find the best coverage for your needs. Drive safely and stay insured!

FAQs About Car Insurance advice

What types of car insurance coverage do I need?

You typically need liability insurance, but you might also consider collision, comprehensive, and PIP based on your vehicle, state laws, and personal needs.

How can I lower my car insurance premiums?

Maintain a clean driving record, increase your deductible, bundle policies, ask about discounts, and shop for quotes regularly to lower premiums.

What factors affect my car insurance rates?

Factors include your driving record, vehicle type, location, credit score, and annual mileage. These impact your insurance risk level.

How often should I review my car insurance policy?

Review your policy annually or after significant changes, such as moving or buying a new car, to ensure it still meets your needs.

What should I do if I get into an accident?

Ensure safety, report the accident to the police and insurer, document the scene, and file a claim for the next steps.